Running a small business is not easy. As an owner, you juggle many responsibilities. You must actively manage operations, meet customer needs and grow your brand. Yet, managing your business finances is one of the most important yet often overlooked tasks.

Still, small mistakes can quickly snowball into major financial problems without a solid perception of accounting. That’s where accounting courses for small business come in.

These courses provide the essential skills to help you track your finances, make wise decisions and avoid costly mistakes.

Whether you’re just starting or looking to grow, learning accounting basics can significantly impact your business’s success. So, let’s learn a few aspects of accounting software for small business.

Accounting Courses for Small Business

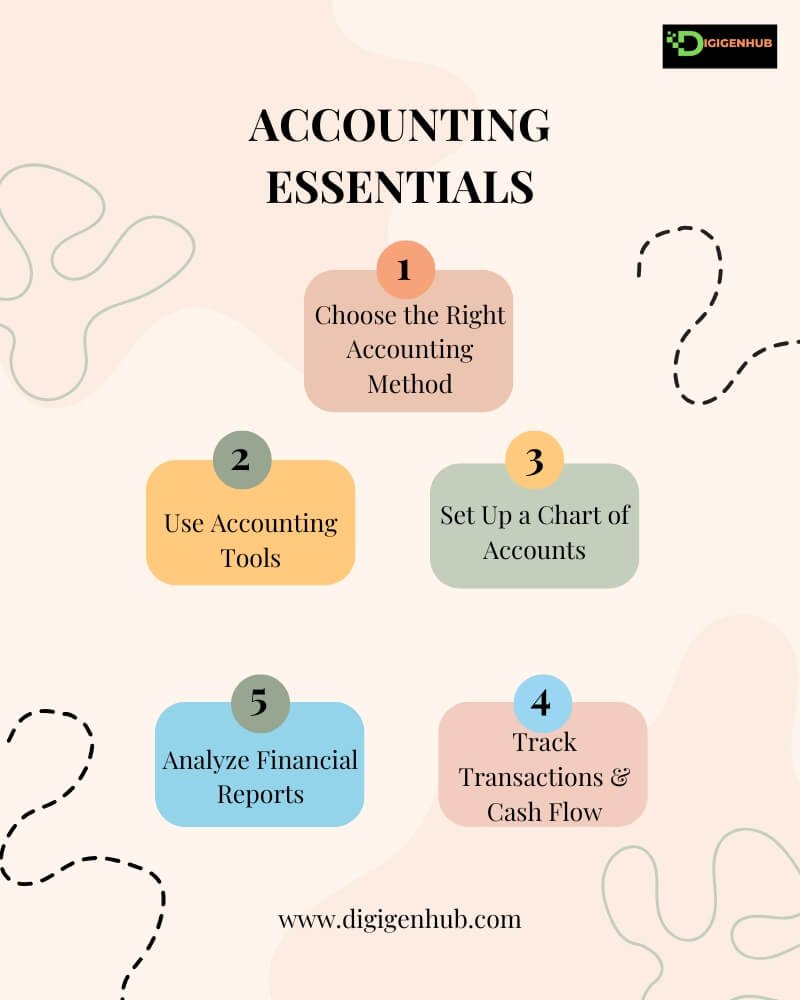

Taking accounting courses helps small businesses manage their finances. These courses teach how to choose the proper accounting method, like cash or accrual accounting. They also cover using tools like QuickBooks or FreshBooks to track expenses, invoices and reports.

Courses show how to set up a chart of accounts and organize finances into categories like income and expenses. They teach how to track every transaction and manage cash flow.

Accounting courses also help you perceive financial reports to make better decisions. With these skills, you can run your business smoothly, stay compliant and plan for growth.

Why Accounting Courses are Important for Small Business

Small businesses face many financial tasks. As their business grows, these tasks get more complex. They need to manage cash flow, track expenses, follow tax rules and plan for the future. Without understanding accounting, mistakes can happen. These mistakes can lead to financial loss or legal problems. That’s why accounting courses for small businesses are so important.

What Accounting Courses Teach

Accounting courses for small businesses teach the basics. Topics include:

- Bookkeeping

- Financial reporting

- Tax Preparation

- Budgeting

- Cash flow management

These skills help owners make better decisions. They can avoid costly mistakes and stay compliant with tax laws. With online courses, owners can learn at their own pace. They can also apply what they learn right away in their business.

Technology and Accounting

Today, many small businesses use cloud-based accounting tools. Software like QuickBooks Online, Xero and Wave are popular. These tools help owners track finances, automate tasks and gain real-time insights. Free tools like Wave and ZipBooks are good for basic needs, while FreshBooks and Zoho Books are great for growing businesses.

Accounting courses for small businesses often teach how to use these tools. Learning how to use accounting software makes financial management easier and more efficient.

Benefits of Bookkeeping Software for Small Business

Let’s learn how accounting courses for small business help:

- Better Financial Management: Courses teach owners how to manage money well. They learn to track income and expenses and make smart budget decisions.

- Fewer Mistakes: With proper knowledge, owners can avoid mistakes like misclassifying expenses or missing tax deadlines.

- Tax Help: Courses cover tax rules. Owners learn to file taxes correctly and take all the deductions they qualify for.

- Business Growth: Accounting knowledge helps owners plan for growth. They can make decisions to help their business succeed in the long run.

Yet, with online courses, getting started and improving your financial skills is easy. The proper knowledge can make a big difference in the success of a small business.

The Most Wanted Paid Accounting Software for Small Business

Managing finances is an integral object for small business success. Still, many owners lack accounting skills. This adversity leads to costly mistakes.

Hence, you must learn how to handle finances confidently through the proper bookkeeping course. Let’s learn a few admirable -paid accounting courses for small business owners to help you improve your financial skills.

1. QuickBooks Online Certification by Intuit

This is an official certification course for QuickBooks Online. Learn to manage bookkeeping, financial reporting and taxes using QuickBooks.

Platform: Intuit

Cost: Varies (Subscription-based)

2. QuickBooks Desktop for Small Business by Intuit Academy

Learn how to use QuickBooks Desktop for invoicing, payroll and financial reporting. Perfect for small businesses using the desktop version.

Platform: Intuit Academy

Cost: Varies (Subscription-based)

3. The Complete Accounting & Finance for Non-Financial Managers by Udemy

This course helps non-financial managers understand accounting and financial principles. Learn budgeting, financial reports and managing cash flow.

Platform: Udemy

Cost: Around $19.99 (often discounted)

4. Accounting for Small Business by edX

A comprehensive guide to accounting for small business. Learn about financial reports, managing cash flow and tax responsibilities.

Platform: edX (University of California, Irvine)

Cost: Free to audit, $49 for certificate

5. Financial Accounting for Entrepreneurs by Udemy

Learn basic financial accounting concepts. This course is tailored for entrepreneurs who need to understand financial statements and manage taxes.

Platform: Udemy

Cost: Around $12.99 (often discounted)

6. Managerial Accounting for Small Businesses by LinkedIn Learning

Focuses on managerial accounting. Learn how to use financial data for decision-making, budgeting and forecasting.

Platform: LinkedIn Learning

Cost: Free with LinkedIn Premium or $29.99/month

7. Xero Accounting Training by Xero Academy

Learn Xero for managing accounts. The course covers invoicing, reconciling bank feeds and creating financial reports.

Platform: Xero Academy

Cost: Free (optional paid certification)

8. Small Business Accounting & Bookkeeping by Coursera (University of California, Irvine)

Teaches the fundamentals of bookkeeping and accounting to small business. Learn how to create financial statements and track cash flow.

Platform: Coursera

Cost: Free to audit, $49 for certificate

9. Small Business Financial Management by Coursera

Covers managing finances for small businesses. Learn budgeting, cash flow management and financial analysis.

Platform: Coursera

Cost: Free to audit, $49 for certificate

10. Accounting and Finance for Non-Financial Managers by Coursera (University of Illinois)

This course explains basic accounting and finance concepts to help managers make business decisions. It is aimed at managers without a financial background.

Platform: Coursera (University of Illinois)

Cost: Free to audit, $49 for certificate

11. Small Business Accounting and Bookkeeping for Entrepreneurs by Udemy

A step-by-step course for entrepreneurs on managing bookkeeping, creating financial reports and tracking business expenses effectively.

Platform: Udemy

Cost: Around $19.99 (often discounted)

12. Financial Management for Small Business by Udemy

Learn how to manage your business finances. This course covers budgeting, controlling expenses and financial forecasting.

Platform: Udemy

Cost: Around $19.99 (often discounted)

13. Taxation for Small Businesses by H&R Block

Learn how to handle taxes for small businesses. Covers tax filing, deductions, tax planning and understanding business tax forms.

Platform: H&R Block

Cost: Varies

14. QuickBooks for Small Business by Intuit QuickBooks Training

This course helps small businesses learn QuickBooks to track income and expenses and generate financial reports.

Platform: Intuit QuickBooks Training

Cost: Varies

15. Advanced Financial Accounting for Small Business by Udemy

An advanced course focusing on complex financial accounting topics. Learn about advanced bookkeeping, audits and tax management.

Platform: Udemy

Cost: Around $19.99 (often discounted)

16. Accounting for Small Business by Coursera (University of California, Irvine)

Teaches small business how to manage financials effectively. Learn about transactions, expenses and reports.

Platform: Coursera (University of California, Irvine)

Cost: Free to audit, $49 for certificate

17. Financial Accounting for Small Business by LinkedIn Learning

Learn financial accounting basics, including balance sheets, income statements and cash flow management.

Platform: LinkedIn Learning

Cost: Free with LinkedIn Premium or $29.99/month

18. Small Business Bookkeeping Basics by Skillshare

Covers the basics of bookkeeping. Learn how to track income expenses and maintain accurate records.

Platform: Skillshare

Cost: $32/month (with free trial)

19. The Complete Business Accounting & Financial Management by Udemy

A complete course on business accounting and financial management. Learn everything from accounting principles to financial decision-making.

Platform: Udemy

Cost: Around $19.99 (often discounted)

20. Introduction to Accounting and Finance for Entrepreneurs by edX

A beginner-friendly course covering the basics of accounting and finance, designed for entrepreneurs.

Platform: edX (University of California, Berkeley)

Cost: Free to audit, $49 for certificate

Yet, you can obtain valuable insights and practical knowledge through these paid accounting courses. From accounting fundamentals to advanced financial management, there’s a course for everyone—whether you’re just starting out or looking to improve your financial skills. Indeed, choose the course that best suits your needs and take control of your business finances.

Accounting Software for Small Business Free

Managing money is key to running a small business. But many owners find accounting hard to understand. Yet, there are free accounting software for small business to teach you the basics of accounting, bookkeeping and managing money.

Whether you are new or want to improve your skills, these resources will help. They cover important topics like taxes, cash flow and using accounting software. So, let’s explain the best free accounting courses for small businesses.

1. Accounting for Small Business Owners

Learn basic accounting concepts like financial reporting and cash flow management.

Platform: edX (University of California, Irvine)

Cost: Free to audit

2. Introduction to Financial Accounting

Covers financial accounting basics, including balance sheets, income statements and cash flow.

Platform: Coursera (University of Pennsylvania)

Cost: Free to audit

3. Small Business Financials

Learn to manage finances, prepare budgets and analyze financial reports for small businesses.

Platform: Coursera (University of California, Irvine)

Cost: Free to audit

4. Financial Accounting Fundamentals

Focuses on key accounting concepts, including financial statements and transaction recording.

Platform: Coursera (University of Virginia)

Cost: Free to audit

5. Accounting Basics

A beginner-friendly course that covers basic accounting, including how to track business finances and manage expenses.

Platform: Khan Academy

Cost: Free

6. Basic Accounting

Learn the accounting fundamentals, from bookkeeping to preparing financial statements.

Platform: OpenLearn (Open University)

Cost: Free

7. Bookkeeping Basics for Small Business

Learn basic bookkeeping skills for managing small business finances, such as transactions and ledger management.

Platform: FutureLearn (Accredited by the Open University)

Cost: Free to audit

8. Intro to Accounting and Financial Statements

Offers an introduction to accounting and how to create and understand financial statements for small businesses.

Platform: Saylor Academy

Cost: Free

9. Managing Small Business Finance

A beginner-level course covering the basics of small business finances, budgeting and using financial data for decisions.

Platform: Coursera (University of London)

Cost: Free to audit

10. Principles of Accounting

A comprehensive introduction to accounting principles, including balance sheets, income statements and cash flow management.

Platform: MIT OpenCourseWare

Cost: Free

Stil, these free accounting courses are perfect for small business. New entrepreneurs can learn the basics of accounting and taxes.

Entrepreneurs on a budget can skip expensive classes. Freelancers can manage their own finances. Small business managers can improve their skills.

Even with no accounting background, these courses teach key concepts. Growing startups can use these resources to handle rising costs and profits.

Conclusion

Thus, you have learned all about both premium and free accounting software for small business. Managing your business finances doesn’t have to be hard! With the right accounting courses or software, you can confidently track expenses, handle taxes and plan for growth.

Whether you choose free tools or paid programs, these resources help you make smarter decisions and avoid costly mistakes. Start learning today and take control of your financial future.

FAQ

Is accounting necessary for small business?

Yes, accounting is essential for small businesses. It helps track money, manage expenses and avoid mistakes. Good accounting keeps your business strong and ready to grow.

What is Bookkeeping Software for Small Business

Bookkeeping software helps small businesses manage their financial records. It simplifies tasks like recording expenses, managing invoices and tracking payments. Popular options include QuickBooks, Xero and Wave. These tools organize transactions, create reports and ensure accurate record-keeping.