High sales mean nothing if bills eat your cash. You must learn the difference between revenue and profit. Otherwise, you will face the business inflation issue.

You sell many products. You check your bank account. The balance is low. Where did the money go?

Inflation stays near 3%. Software costs go up. Ad bills grow fast. You make cash, but you keep nothing.

This happens when you confuse total sales with real earnings.

The Difference Between Revenue and Profit

You must separate these two numbers to survive. They tell you completely different things about your business.

Revenue is all the money you collect. You get this from selling products or services. You have not paid any bills yet. Revenue shows people want your product.

Profit is the money you actually keep. You calculate this after paying every single bill. Profit proves your business model actually works.

Many new sellers chase revenue. They want to show off big sales numbers.

Dedicated business owners chase profit. You cannot buy food with revenue. You only spend profit.

Revenue vs Profit

| Feature | Revenue | Profit |

| Meaning | Total money brought in by sales. | Money left over after paying all bills. |

| Math Formula | Price per unit × Number of units sold | Total Revenue – Total Expenses |

| Main Goal | Measures sales volume and market demand. | Measures financial health and survival. |

| Report Spot | The very top line of your income statement. | The very bottom line of your income statement. |

| What It Proves | Customers want to buy what you sell. | Your business makes money efficiently. |

How to Calculate Profit Margin Right Now

You only need basic math to find your margin. You do not need a fancy degree.

You use a specific formula to see how much cash you keep from every dollar you make.

The Exact Procedure You Need

First, find your Net Profit (Total Revenue minus Total Costs).

Second, divide your Net Profit by your Total Revenue.

Third, multiply that result by 100 to get your percentage.

Process: (Net Profit / Revenue) x 100 = Profit Margin Percentage

Imagine you run an online store selling digital courses to US customers.

1 . You make $10,000 in sales this month. This is your revenue.

2 . You pay $6,000 for web hosting, software tools, and digital ads. This is your total cost.

3 . You subtract $6,000 from $10,000. You have $4,000 left. This is your net profit.

4 . You divide 4,000 by 10,000. You get 0.40.

5 . You multiply 0.40 by 100. Your final number is 40%.

6 . Your margin is 40%. You keep 40 cents from every single dollar you make.

What Are the 3 Major Types of Profit Margin?

You cannot group all your expenses. You must break them down. Different costs tell you different stories about your company. You have three main numbers to track.

3 Major Types of Profit Margins

| Name of Margin | What It Measures | The Math Formula |

| Gross Margin | Production efficiency | (Revenue – Cost of Goods Sold) / Revenue x 100 |

| Operating Margin | Daily business efficiency | (Operating Profit / Revenue) x 100 |

| Net Margin | Total financial survival | (Net Profit / Revenue) x 100 |

1. Gross Profit Margin

This number tells you if your product costs too much to make. You only subtract the direct costs of making your item.

We call this the Cost of Goods Sold (COGS). If you buy a physical product from a factory for $20 and sell it for $100, your gross profit is $80. Your gross margin is 80%.

New US tariffs make COGS higher for many sellers. This pushes gross margins down.

2. Operating Profit Margin

This number tells you if your daily business habits cost too much. You take your gross profit and subtract everyday bills.

These bills include rent, staff wages, and marketing ads. You do not include taxes or bank loans yet.

If you waste money on bad Facebook ads, your operating margin drops fast.

3. Net Profit Margin

This is the final bottom line. You take your operating profit and subtract everything else. You pay your taxes.

You pay your bank interest. The cash left over is your net profit. You divide this by your total revenue.

This final percentage proves whether your company actually makes money.

Why Do People Confuse Margin With Markup?

This is the biggest math error new business owners make. They think these two words mean the same thing.

They do not. Mixing them up causes you to set prices too low.

Margin shows the percentage of the selling price that is profit.

Markup shows the percentage added to your cost to create the selling price.

Margin bases its math on the final sale price.

Markup bases its math on the factory cost.

An Easy Example of the Difference

You buy a desk for $60. You sell it for $100. You make $40 in profit.

Your Margin: You divide the $40 profit by the $100 sale price. Your margin is 40%.

Your Markup: You divide the $40 profit by the $60 cost. Your markup is 66.6%.

If you want a 40% margin, you cannot just mark up your product by 40%. If you buy a desk for $60 and mark it up 40% (adding $24), you sell it for $84.

If you sell it for $84, your actual margin drops to 28%. You will lose money if you do this math backward.

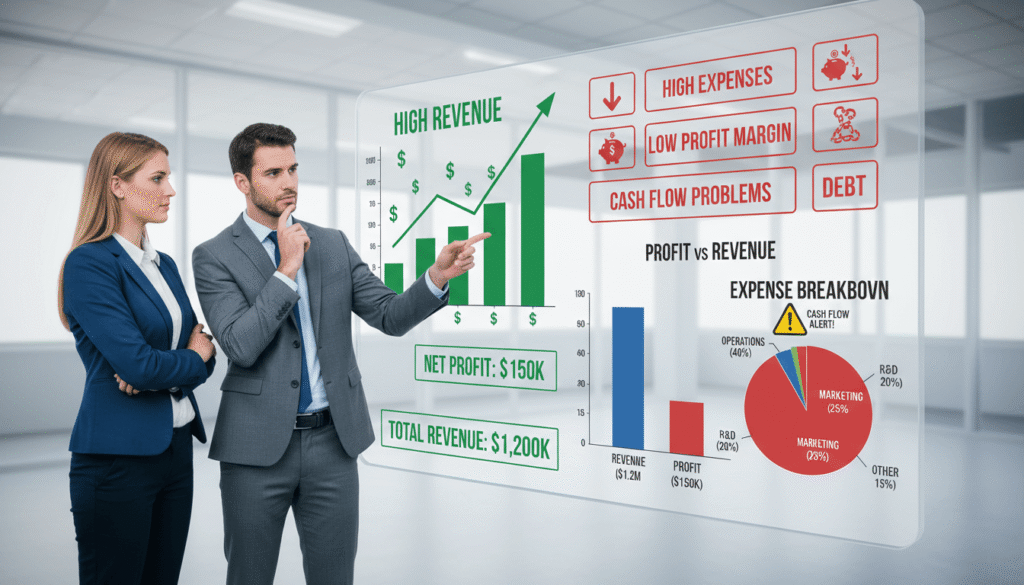

Why Does High Revenue Not Guarantee Business Success?

High sales do not equal success. Your expenses might grow faster than your sales. Paid ads can eat all your money.

A broken business model will fail, even with high sales. Calculate the Google search and other social media ads.

Imagine an online store. They sell $200,000 worth of goods this month. The owner feels great. But they spent $120,000 on Facebook ads.

They spent $60,000 on product manufacturing.

They spent $30,000 on staff. Their total expenses equal $210,000. They generated huge sales. But they lost $10,000.

How Can You Increase Profit Margins Without Losing Revenue?

You do not always need more customers. You need better money habits. You can extract more cash from the sales you already have. Here is how you do it today.

1. Audit Your Recurring Software

Many online businesses waste money here.

How to resolve

Download your bank statements right now. Look at the last 90 days. Find every monthly charge. Cancel tools you do not use. I run a digital content hub. I recently found I was paying for three different email tools. I canceled two. I saved $200 a month immediately. That is pure profit.

2. Increase Your Average Order Value

Getting a new buyer costs money. Make them spend more at checkout.

How to address

Add a simple upsell. If you sell a physical product, offer fast shipping for $5 more. If you sell digital products, offer a small audio guide for $10 extra. This costs you almost nothing to fulfill.

3. Adjust Pricing Strategically

US inflation is real. Your costs went up. Your prices must go up too.

Solution for

Do not change everything at once. Pick your best product. Raise the price by 4%. Most buyers will not care or even notice. You keep that extra money.

4. Negotiate Better Rates

You can get better prices just by asking.

How to handle

Contact three different software or shipping providers. Ask them for a price quote. Take the lowest quote to your current vendor. Ask them to match the price. They usually will.

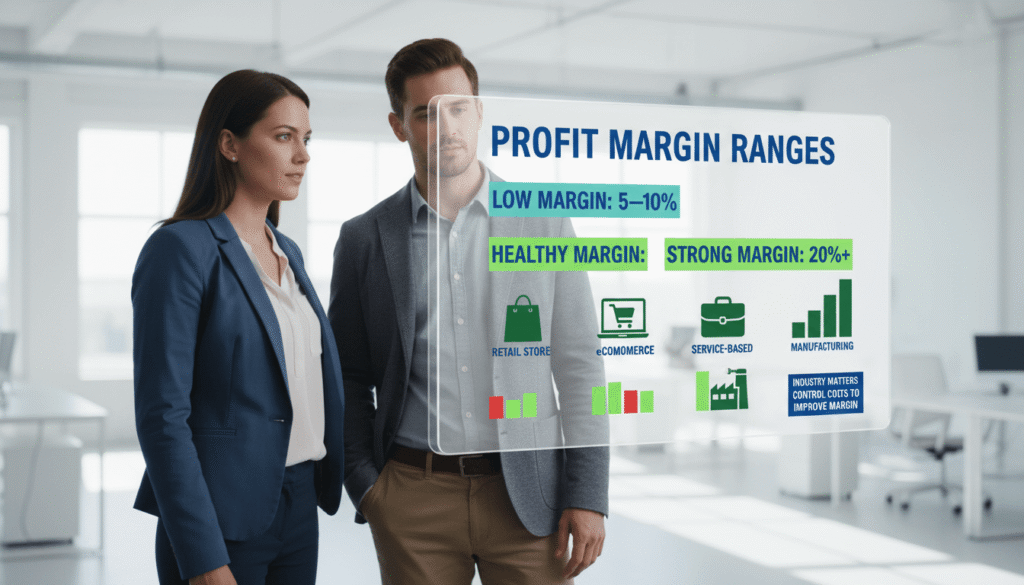

What Is a Good Profit Margin for US Sellers?

A “good” number depends totally on what you sell. You cannot compare a grocery store to a software company. Recent 2026 data from TrueProfit shows the average metrics for online stores.

General US e-commerce stores sit between 15% and 30% net margin.

Print-on-demand businesses hit around 26% net margin.

Dropshipping businesses sit lower at 18% due to high ad costs.

Physical stores have much lower numbers. A local US grocery store might survive on a 2% net margin because it sells thousands of items a day.

A digital product business might hit a 70% net margin because it has zero shipping costs.

Conclusion

You now know how revenue and profit differ. You know why tracking both will save your business. Revenue feeds your ego. Profit feeds your family. You cannot fix what you do not measure.

Open a simple spreadsheet today. List your total revenue for last month. Below it, list every single expense, tax payment, and software fee. Subtract the expenses from the revenue. Look at that final number. That is your real profit. Find one unused software tool today and cancel it. Find one product and raise the price by 3%. Start protecting your cash right now.

FAQ

How do US revenue rules (ASC 606) change when I record a sale?

Under US accounting rules, you cannot record revenue just because you signed a contract.

You only recognize the revenue when you actually deliver the product or service to the customer.

What is deferred revenue in an online subscription business?

If a customer pays you $1,200 today for a one-year software plan, you do not have $1,200 in recognized revenue.

You have $100 in revenue for the first month. The remaining $1,100 is deferred revenue. This acts as a debt on your balance sheet until you provide the service.

Does selling gift cards count as instant profit?

No. When someone buys a gift card from your store, you collect cash, but you owe them a product.

You cannot count that cash as revenue or profit until the customer actually spends the gift card.

How does inventory counting (LIFO) change my tax bill?

If you use the Last-In, First-Out (LIFO) method, you count your most expensive, recently bought items as sold first.

This lowers your paper profit and legally reduces your tax bill.

Do I record payment processor fees before or after calculating revenue?

You record your full revenue first. If a customer pays $100, your revenue is exactly $100.

The $3 fee taken by a credit card processor is an operating expense. You subtract it later to find your net profit.

Can a business have negative profit but positive cash flow?

Yes. If you take out a large business loan, your bank account fills with cash. However, a loan is not revenue.

If your daily expenses still exceed your daily sales, your profit remains negative even though your bank balance looks high.

What happens to my profit if a customer demands a refund?

A refund directly reverses your recorded revenue. You must subtract the refunded amount from your top-line sales.

Because your operating expenses (like original shipping and ad costs) remain the same, a single refund hurts your final profit margin heavily.